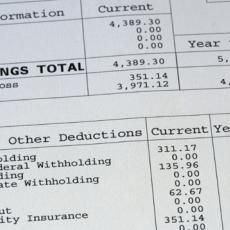

Section 226 of the Labor Code requires that employers put certain information on an itemized wage statement, otherwise known as a paycheck stub. If the employee suffers injury due to the employer’s failure to include any of the information can result in a penalty calculated at $100 per pay period for each employee, to a maximum of $4,000.00 and attorneys’ fees.

The law deems an employee to suffer injury if any of the information is not included on the paycheck stub and the employee can’t, from looking at the paycheck stub determine: (1) hours worked, pieces completed, deductions taken, the payroll period or the hourly wage; (2) which deductions the employer made; (3) the name and address of the employer; or (4) the name of the employee and the last four digits of the social security number of employee identification number.

Yes, you heard it correctly. Failure to include a partial social security number is deemed to cause the employee actual injury. Ouch! This is the basis of the lawsuit filed in Fresno County last Thursday by Jeremy Mason against Lion Raisins, Inc.

It’s the employer who is actually injured. Why? Because the employer is facing a lawsuit which may result in employees obtaining $4,000.00 each and their attorneys all of their fees. These cases can be very lucrative and attorneys are very eager to take these cases because of the attorneys’ fee provision.

Review your paycheck stubs. Make sure all of the necessary information is included on them.

And don’t forget that beginning July 1, 2015 the paycheck stub must also include the amount of paid sick leave available for use. Failure to provide this on a paycheck stub results in a separate $100 per pay period, per employee, penalty … plus attorneys’ fees.

Those lucky attorneys! This crazy state!