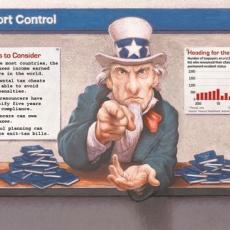

The WSJ recently reported that there has been a huge increase in the numbers of Americans living overseas who have renounced their U.S. citizenship:

Here is a sign that life is getting complicated for U.S. taxpayers with assets abroad: More of them are deciding they are better off cutting official ties with America.

In the first half of 2013, 1,809 people renounced their American citizenship or permanent-resident status, according to a tally by Andrew Mitchel, a tax lawyer who tracks U.S. data. At that pace, the 2013 total would double the previous high of 1,781 renunciations in 2011….

The increase in renunciations is one sign that ordinary Americans who have lived and worked abroad for years, as well as green-card holders in the U.S. and overseas, believe they are at growing risk because of the intensifying government pursuit of undeclared foreign assets.

The crackdown started in the wake of the 2001 terrorist attacks, and it gathered force after Swiss banking giant UBS AG UBSN.VX -1.91%agreed in 2009 to pay $780 million to settle charges it had helped U.S. taxpayers hide assets.

Since then, more than 80 U.S. taxpayers have been criminally charged, and Switzerland’s oldest bank, Wegelin & Co., closed down after pleading guilty to helping U.S. taxpayers hide more than $1.2 billion abroad.

On Friday, a prominent Swiss lawyer pleaded guilty in U.S. court to helping U.S. taxpayers hide millions of dollars abroad….

But many U.S. taxpayers who aren’t wealthy also are finding it harder to attend to routine financial matters abroad, because some foreign institutions don’t want to face the cost of complying with U.S. requirements.

Amid the crackdown, some face stiff U.S. tax bills and crippling fines over undeclared assets. Paying lawyers and accountants to help meet the various reporting and filing requirements routinely costs at least $1,000 a year, and often much more, experts say.

Other people say they are considering whether to renounce but are reluctant to take such a drastic step. Renouncing can cause additional complications, including another steep bill because of an exit tax the U.S. imposes on those who meet certain income or asset thresholds….

Despite the campaign against undeclared accounts, U.S. taxpayers filed only 825,000 foreign-account reports last year—meaning that millions of people likely aren’t complying with the law.